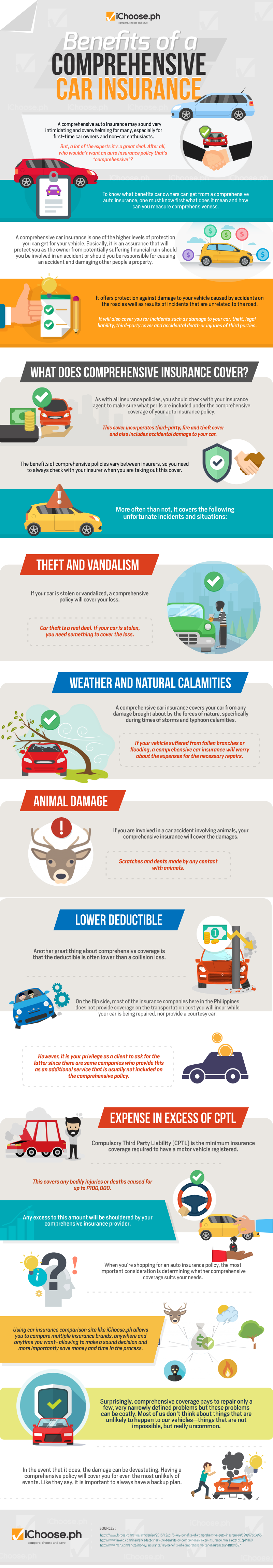

Benefits of a Comprehensive Car Insurance [Infographic]

Comprehensive auto insurance may sound very intimidating and overwhelming for many, especially for first-time car owners and non-car enthusiasts.

But, a lot of the experts it’s a great deal. After all, who wouldn’t want an auto insurance policy that’s “comprehensive”?

To know what benefits car owners can get from comprehensive auto insurance, one must know first what does it mean and how can you measure comprehensiveness.

Comprehensive car insurance is one of the higher levels of protection you can get for your vehicle. Basically, it is an assurance that will protect you as the owner from potentially suffering financial ruin should you be involved in an accident or should you be responsible for causing an accident and damaging other people’s property.

It offers protection against damage to your vehicle caused by accidents on the road as well as results of incidents that are unrelated to the road. It will also cover you for incidents such as damage to your car, theft, legal liability, third-party cover, and accidental death or injuries of third parties.

What Does Comprehensive Insurance Cover?

As with all insurance policies, you should check with your insurance agent to make sure what perils are included under the comprehensive coverage of your auto insurance policy. This cover incorporates third-party, fire and theft cover and also includes accidental damage to your car. The benefits of comprehensive policies vary between insurers, so you need to always check with your insurer when you are taking out this cover. More often than not, it covers the following unfortunate incidents and situations:

Theft and Vandalism

If your car is stolen or vandalized, a comprehensive policy will cover your loss. Car theft is a real threat. If your car is stolen, you need something to cover the loss.

Weather and Natural Calamities

Comprehensive car insurance covers your car from any damage brought about by the forces of nature, specifically during times of storms and typhoon calamities.

If your vehicle suffered from fallen branches or flooding, comprehensive car insurance will worry about the expenses for the necessary repairs.

Animal Damage

If you are involved in a car accident involving animals, your comprehensive insurance will cover the damages. Scratches and dents made by any contact with animals.

Lower Deductible

Another great thing about comprehensive coverage is that the deductible is often lower than a collision loss.

On the flip side, most of the insurance companies here in the Philippines does not provide coverage on the transportation cost you will incur while your car is being repaired, nor provide a courtesy car.

However, it is your privilege as a client to ask for the latter since there are some companies that provide this as an additional service that is usually not included in the comprehensive policy.

Expense in Excess of CPTL

Compulsory Third Party Liability (CPTL) is the minimum insurance coverage required to have a motor vehicle registered. This covers any bodily injuries or deaths caused by up to P100,000. Any excess to this amount will be shouldered by your comprehensive insurance provider.

When you’re shopping for an auto insurance policy, the most important consideration is determining whether comprehensive coverage suits your needs. Using a car insurance comparison site like iChoose.ph allows you to compare multiple insurance brands, anywhere and anytime you want- allowing to make a sound decision and more importantly save money and time in the process.

Surprisingly, comprehensive coverage pays to repair only a few, very narrowly defined problems but these problems can be costly. Most of us don’t think about things that are unlikely to happen to our vehicles—things that are not impossible, but really uncommon.

In the event that it does, the damage can be devastating. Having a comprehensive policy will cover you for even the most unlikely of events. As they say, it is important to always have a backup plan.

More useful reads from iChoose.ph