Navigating the 2023 Car Insurance Landscape in the Philippines

In the dynamic world of the Philippines car insurance industry, 2023 brings a lot of changes and challenges for both users and policyholders. As the year unfolds, its crucial for anyone in the market for car insurance to stay informed about the latest trendsand updates. In this article, we explore the evolving landscape of car insurance in the Philippines in 2023 and provide valuable insights for those seeking coverage.

Key Trends in the Car Insurance Industry

- Digitalization and Online Services

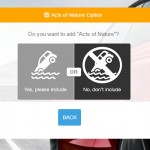

2023 continues the trend of digitization in the insurance sector. Car insurance providers are increasingly offering online servides, from policy purchasing to claims processing. This not only makes it more convenient for customers but also streamlines administrative processes for insurers.

When searching for car insurance in the Philippines, consider insurers that offer user-friendly website and mobile apps for policy management and claims submission. This can save you time and make your insurnace experience more efficient.

2. Personalized Policies

One size does not fit all in car insurance, and companies are acknowledging this by offering more personalized policies. Insurers now consider various factors such as your claims history, vehicle type and sometimes your location to provide tailored coverage options. This trend benefits consumers by allowing them to choose coverage that suits their individual needs and budgets.

3. Mall Insurance Hubs

As early as 2018 we have seen car insurance being sold to popular Malls in the country. As of writing Ichoose.ph Hub – a one stop shop insurance hub in the country has been distributing car insurance and various Insurance products has more than 10 hubs in the Metro areas. There you can interact with the concierge mondays to sundays operating in mall hours.iChoose.ph Hub has more than 10 locations in various SM Malls in Metro Manila.

Choosing the Right Car Insurance in 2023

With these trends in mind, here are some tips for finding the right car insurance in the Philippines for 2023.

- Compare quotes: Shop around and obtain quotes from mulitiple insurers. Use online comparison tools to streamline the process and find the best rates.

- Assess your Needs: Consider your specific needs and preferences. Are you looking for basic coverag “CTPL” or comprehensive protection? Do you want additional features like roadside assistance?

- Check Reviews: Research the reputation and customer reviews of insurance companies. Look for feedback on their claims process and customer service.

- Understand the Terms : Carefully read and understand the terms and conditions of your chosen policy. Pay attention to coverage limits, deductibles and any exclusions.

- Ask Questions: Don’t hesistate to ask your insurnace broker or agent questions if you’re unsure about any aspect of the policy.

- Safety and Security: Invest safety features for your vehicle, such as anti-theft devices and dash cams. Some provider has some discounts for these security enhancements.

Conclusion

In 2023, the car insurance industry in the Philippines is embracing digitization, personalization and mall distribution channels. These trends offer new opportunities for consumers to find coverage that suits their unique needs and budgets. When searching for car insurance, take advantage of online resources, compare quotes and carefully assess your requirements to make an informed decision. By staying informed and proactive, you can navigate the evolving car insurance landscape in the Philippines with confidence.

More useful reads from iChoose.ph