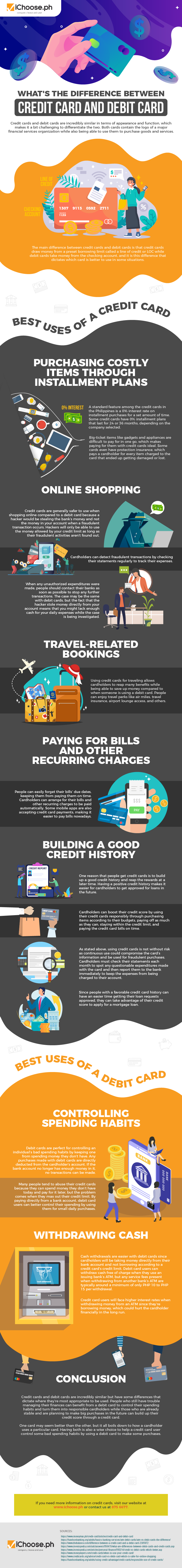

What’s the Difference Between Credit Card and Debit Card? [Infographic]

Credit cards and debit cards are incredibly similar in terms of appearance and function, which makes it a bit challenging to differentiate the two. Both cards contain the logo of a major financial services organization while also being able to use them to purchase goods and services.

The main difference between credit cards and debit cards is that credit cards draw money from a preset borrowing limit called a line of credit or LOC while debit cards take money from the checking account, and it is this difference that dictates which card is better to use in some situations.

Best Uses of a Credit Card

Purchasing Costly Items Through Installment Plans

A standard feature among the credit cards in the Philippines is a 0% interest rate on installment purchases for a set amount of time. Some credit cards have 0% installment plans that last for 24 or 36 months, depending on the company selected.

Big-ticket items like gadgets and appliances are difficult to pay for in one go, which makes paying for them with credit cards ideal. Some cards even have protection insurance, which pays a cardholder for every item charged to the card that ended up getting damaged or lost.

Online Shopping

Credit cards are generally safer to use when shopping online compared to a debit card because a hacker would be stealing the bank’s money and not the money in your account when a fraudulent transaction occurs. Hackers will only be able to use the money allowed by your credit limit as long as their fraudulent activities aren’t found out.

Cardholders can detect fraudulent transactions by checking their statements regularly to track their expenses. When any unauthorized expenditures were made, people should contact their banks as soon as possible to stop any further transactions. The case may be the same with debit cards, but the fact that the hacker stole money directly from your account means that you might lack enough cash for your daily expenses while the case is being investigated.

Travel-Related Bookings

Using credit cards for traveling allows cardholders to reap many benefits while being able to save up money compared to when someone is using a debit card. People can enjoy travel perks like air miles, travel insurance, airport lounge access, and others.

Paying for Bills and Other Recurring Charges

People can easily forget their bills’ due dates, keeping them from paying them on time. Cardholders can arrange for their bills and other recurring charges to be paid automatically.

Some mobile apps are also accepting credit card payments, making it easier to pay bills nowadays.

Building a Good Credit History

One reason that people get credit cards is to build up a good credit history and reap the rewards at a later time. Having a positive credit history makes it easier for cardholders to get approved for loans in the future.

Cardholders can boost their credit score by using their credit cards responsibly through purchasing items according to their budgets, paying off as much as they can, staying within the credit limit, and paying the credit card bills on time.

As stated above, using credit cards is not without risk as continuous use could compromise the card’s information and be used for fraudulent purchases. Cardholders must check their statements each month to spot any questionable expenditures made with the card and then report them to the bank immediately to keep the expenses from being charged to their account.

Since people with a favorable credit card history can have an easier time getting their loan requests approved, they can take advantage of their credit score to apply for a mortgage loan.

Best Uses of a Debit Card

Controlling Spending Habits

Debit cards are perfect for controlling an individual’s bad spending habits by keeping one from spending money they don’t have. Any purchases made with debit cards are directly deducted from the cardholder’s account. If the bank account no longer has enough money in it, no transactions can be made.

Many people tend to abuse their credit cards because they can spend money they don’t have today and pay for it later, but the problem comes when they max out their credit limit. By paying directly from a bank account, debit card users can better control their spending by using them for small daily purchases.

Withdrawing Cash

Cash withdrawals are easier with debit cards since cardholders will be taking money directly from their bank account and not borrowing according to a credit card’s credit limit. Debit card users can withdraw cash free of charge when they use an issuing bank’s ATM, but any service fees present when withdrawing from another bank’s ATM are typically around a minimum of only PHP 10 to PHP 15 per withdrawal.

Credit card users will face higher interest rates when withdrawing money from an ATM since they’re borrowing money, which could hurt the cardholder financially in the long run.

Conclusion

Credit cards and debit cards are incredibly similar but have some differences that dictate where they’re most appropriate to be used. People who still have trouble managing their finances can benefit from a debit card to control their spending habits and turn them into responsible cardholders while those who are already stable and are planning to make big purchases in the future can build up their credit score through a credit card.

One card may seem better than the other, but it all boils down to how a cardholder uses a particular card. Having both is also a wise choice to help a credit card user control some bad spending habits by using a debit card to make some purchases.

If you need more information on credit cards and debit cards, visit our website at www.ichoose.ph or contact us at 875 6677.

More useful reads from iChoose.ph