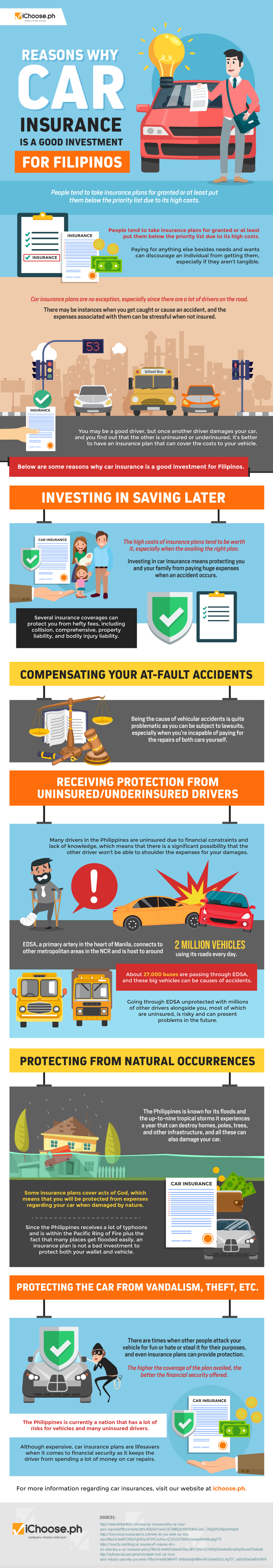

Reasons Why Car Insurance is a Good Investment for Filipinos [Infographic]

People tend to take insurance plans for granted or at least put them below the priority list due to its high costs. An individual can argue that food, housing, and utilities take priority over getting insured since they are necessities. Paying for anything else besides needs and wants can discourage an individual from getting them, especially if they aren’t tangible.

An individual’s current expenses may seem to be a hindrance in getting insured, but it is often when an accident occurs, and one loses money for different costs that the person realizes the real importance of an insurance plan.

Car insurance plans are no exception, especially since there are a lot of drivers on the road. There may be instances when you get caught or cause an accident, and the expenses associated with them can be stressful when not insured. You may be a good driver, but once another driver damages your car, and you find out that the other is uninsured or under insured, it’s better to have an insurance plan that can cover the costs to your vehicle.

Below are some reasons why car insurance is a good investment for Filipinos.

Investing in Saving Later

The high costs of insurance plans tend to be worth it, especially when the availing the right plan. Investing in car insurance means protecting you and your family from paying huge expenses when an accident occurs.

Several insurance coverages can protect you from hefty fees, including collision, comprehensive, property liability, and bodily injury liability.

Compensating Your At-fault Accidents

Being the cause of vehicular accidents is quite problematic as you can be subject to lawsuits, especially when you’re incapable of paying for the repairs of both cars yourself.

Receiving Protection from Uninsured/Underinsured Drivers

Many drivers in the Philippines are uninsured due to financial constraints and lack of knowledge, which means that there is a significant possibility that the other driver won’t be able to shoulder the expenses for your damages.

EDSA, a primary artery in the heart of Manila, connects to other metropolitan areas in the NCR and is host to around 2 million vehicles using its roads every day. About 27,000 buses are passing through EDSA, and these big vehicles can be causes of accidents. Going through EDSA unprotected with millions of other drivers alongside you, most of which are uninsured, is risky and can present problems in the future.

Protecting from Natural Occurrences

The Philippines is known for its floods and the up-to-nine tropical storms it experiences a year that can destroy homes, poles, trees, and other infrastructure, and all these can also damage your car.

Some insurance plans cover acts of God, which means that you will be protected from expenses regarding your car when damaged by nature. Since the Philippines receives a lot of typhoons and is within the Pacific Ring of Fire plus the fact that many places get flooded easily, an insurance plan is not a bad investment to protect both your wallet and vehicle.

Protecting the Car from Vandalism, Theft, etc.

There are times when other people attack your vehicle for fun or hate or steal it for their purposes, and even insurance plans can provide protection. The higher the coverage of the plan availed, the better the financial security offered.

The Philippines is currently a nation that has a lot of risks for vehicles and many uninsured drivers. Although expensive, car insurance plans are lifesavers when it comes to financial security as it keeps the driver from spending a lot of money on car repairs.

For more information regarding car insurances, visit our website at ichoose.ph.

Sources:

More useful reads from iChoose.ph