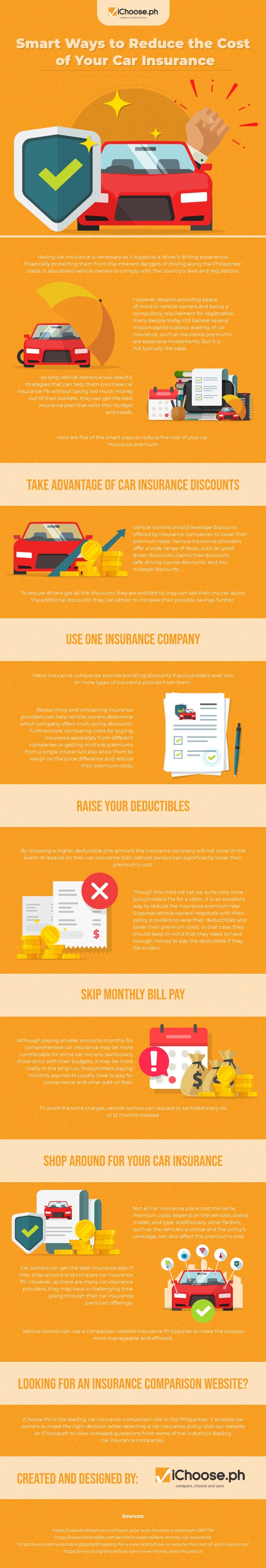

Smart Ways to Reduce the Cost of Your Car Insurance [Infographic]

Having car insurance is necessary as it supports a driver’s driving experience, financially protecting them from the inherent dangers of driving along the Philippines’ roads. It also allows vehicle owners to comply with the country’s laws and regulations.

However, despite providing peace of mind to vehicle owners and being a compulsory requirement for registration, many people today still believe several misconceptions about availing of car insurance, such as insurance premiums are expensive investments. But it is not typically the case.

As long vehicle owners know specific strategies that can help them purchase car insurance Ph without taking too much money out of their pockets, they can get the best insurance plan that suits their budget and needs.

Here are five of the smart ways to reduce the cost of your car insurance premium:

Take advantage of car insurance discounts.

Vehicle owners should leverage discounts offered by insurance companies to lower their premium rates. Various insurance providers offer a wide range of deals, such as good driver discounts, claims-free discounts, safe driving course discounts, and low mileage discounts.

To ensure drivers get all the discounts they are entitled to, they can ask their insurer about the additional discounts they can obtain to increase their possible savings further.

Use one insurance company.

Many insurance companies provide bundling discounts if policyholders avail two or more types of insurance policies from them.

Researching and contacting insurance providers can help vehicle owners determine which company offers multi-policy discounts. Furthermore, comparing costs for buying insurance separately from different companies or getting multiple premiums from a single insurer will also allow them to weigh on the price difference and reduce their premium costs.

Raise your deductibles

By choosing a higher deductible (the amount the insurance company will not cover in the event of repairs) on their car insurance plan, vehicle owners can significantly lower their premium’s cost.

Though this method can be quite risky once policyholders file for a claim, it is an excellent way to reduce the insurance premium rate. Suppose vehicle owners negotiate with their policy providers to raise their deductibles and lower their premium costs. In that case, they should keep in mind that they need to have enough money to pay the deductible if they file a claim.

Skip monthly bill pay

Although paying smaller amounts monthly for comprehensive car insurance may be more comfortable for some car owners, particularly those strict with their budgets, it may be more costly in the long run. Policyholders paying monthly payments usually have to pay for convenience and other add-on fees.

To avoid the extra charges, vehicle owners can request to be billed every six or 12 months instead.

Shop around for your car insurance

Not all car insurance plans cost the same. Premium costs depend on the vehicle’s brand, model, and type. Additionally, other factors, such as the vehicle’s purpose and the policy’s coverage, can also affect the premium’s cost.

Car owners can get the best insurance plan if they shop around and compare car insurance Ph. However, as there are many car insurance providers, they may have a challenging time going through their car insurance premium offerings.

Vehicle owners can use a comparison website insurance Philippines to make the process more manageable and efficient.

Looking for an insurance comparison website?

iChoose PH is the leading car insurance comparison site in the Philippines. It enables car owners to make the right decision when selecting a car insurance policy. Visit our website at iChoose.ph to view unbiased quotations from some of the industry’s leading car insurance companies.

Sources:

- https://www.thebalance.com/lower-your-auto-insurance-premium-1387716

- https://www.nerdwallet.com/article/insurance/save-money-car-insurance

- https://www.carinsurance.org/guide/shopping-for-a-new-policy/how-to-reduce-the-cost-of-auto-insurance/

- https://www.iii.org/article/how-can-i-save-money-auto-insurance

More useful reads from iChoose.ph