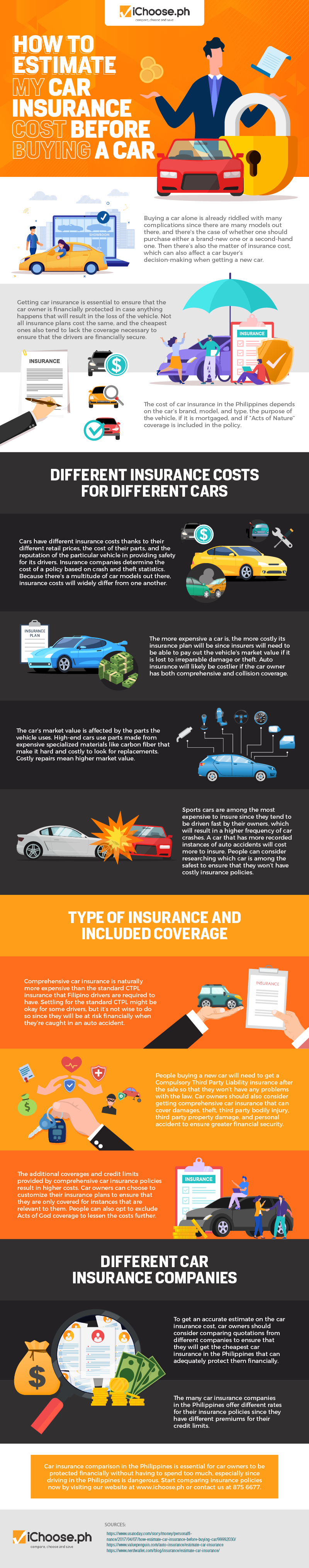

How to Estimate My Car Insurance Cost Before Buying a Car [INFOGRAPHIC]

Buying a car alone is already riddled with many complications since there are many models out there, and there’s the case of whether one should purchase either a brand-new one or a second-hand one. Then there’s also the matter of insurance cost, which can also affect a car buyer’s decision-making when getting a new car.

Getting car insurance is essential to ensure that the car owner is financially protected in case anything happens that will result in the loss of the vehicle. Not all insurance plans cost the same, and the cheapest ones also tend to lack the coverage necessary to ensure that the drivers are financially secure.

The cost of car insurance in the Philippines depends on the car’s brand, model, and type, the purpose of the vehicle, if it is mortgaged, and if “Acts of Nature” coverage is included in the policy.

Different Insurance Costs for Different Cars

Cars have different insurance costs thanks to their different retail prices, the cost of their parts, and the reputation of the particular vehicle in providing safety for its drivers. Insurance companies determine the cost of a policy based on crash and theft statistics. Because there’s a multitude of car models out there, insurance costs will widely differ from one another.

The more expensive a car is, the more costly its insurance plan will be since insurers will need to be able to pay out the vehicle’s market value if it is lost to irreparable damage or theft. Auto insurance will likely be costlier if the car owner has both comprehensive and collision coverage.

The car’s market value is affected by the parts the vehicle uses. High-end cars use parts made from expensive specialized materials like carbon fiber that make it hard and costly to look for replacements. Costly repairs mean higher market value.

Sports cars are among the most expensive to insure since they tend to be driven fast by their owners, which will result in a higher frequency of car crashes. A car that has more recorded instances of auto accidents will cost more to insure. People can consider researching which car is among the safest to ensure that they won’t have costly insurance policies.

Type of Insurance and Included Coverage

Comprehensive car insurance is naturally more expensive than the standard CTPL insurance that Filipino drivers are required to have. Settling for the standard CTPL might be okay for some drivers, but it’s not wise to do so since they will be at risk financially when they’re caught in an auto accident.

People buying a new car will need to get a Compulsory Third Party Liability insurance after the sale so that they won’t have any problems with the law. Car owners should also consider getting comprehensive car insurance that can cover damages, theft, third party bodily injury, third party property damage, and personal accident to ensure greater financial security.

The additional coverages and credit limits provided by comprehensive car insurance policies result in higher costs. Car owners can choose to customize their insurance plans to ensure that they are only covered for instances that are relevant to them. People can also opt to exclude Acts of God coverage to lessen the costs further.

Different Car Insurance Companies

To get an accurate estimate on the car insurance cost, car owners should consider comparing quotations from different companies to ensure that they will get the cheapest car insurance in the Philippines that can adequately protect them financially.

The many car insurance companies in the Philippines offer different rates for their insurance policies since they have different premiums for their credit limits.

Car insurance comparison in the Philippines is essential for car owners to be protected financially without having to spend too much, especially since driving in the Philippines is dangerous. Start comparing insurance policies now by visiting our website at www.ichoose.ph or contact us at 875 6677.

More useful reads from iChoose.ph