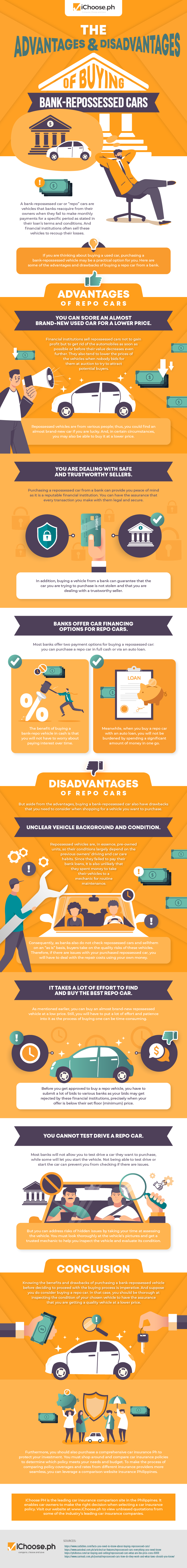

The Advantages and Disadvantages of Buying Bank-Repossessed Cars

A bank-repossessed car or “repo” cars are vehicles that banks reacquire from their owners when they fail to make monthly payments for a specific period as stated in their loan’s terms and conditions. And financial institutions often sell these vehicles to recoup their losses.

If you are thinking about buying a used car, purchasing a bank-repossessed vehicle may be a practical option for you. Here are some of the advantages and drawbacks of buying a repo car from a bank.

Advantages of Repo Cars

You can score an almost brand-new used car for a lower price.

Financial institutions sell repossessed cars not to gain profit but to get rid of the automobiles as soon as possible or before their value decreases even further. They also tend to lower the prices of the vehicles when nobody bids for them at auction to try to attract potential buyers.

Repossessed vehicles are from various people; thus, you could find an almost brand-new car if you are lucky. And, in certain circumstances, you may also be able to buy it at a lower price.

You are dealing with safe and trustworthy sellers.

Purchasing a repossessed car from a bank can provide you peace of mind as it is a reputable financial institution. You can have the assurance that every transaction you make with them legal and secure. In addition, buying a vehicle from a bank can guarantee that the car you are trying to purchase is not stolen and that you are dealing with a trustworthy seller.

Banks offer car financing options for repo cars.

Most banks offer two payment options for buying a repossessed car: you can purchase a repo car in total cash or via an auto loan. The benefit of buying a bank-repo vehicle in money is that you will not have to worry about paying interest over time. Meanwhile, when you buy a repo car with an auto loan, you will not be burdened by spending a significant amount of money in one go.

Disadvantages of Repo Cars

But aside from the advantages, buying a bank-repossessed car also has drawbacks that you need to consider when shopping for a vehicle you want to purchase.

Dark vehicle background and condition.

Repossessed vehicles are, in essence, pre-owned units, so their conditions largely depend on the previous owners’ driving and car care habits. Since they failed to pay their bank loans, it is also unlikely that they spent money to take their vehicles to a mechanic for routine maintenance.

Consequently, as banks also do not check repossessed cars and sell them on an “as is” basis, buyers take on the quality risks of these vehicles. Therefore, if there are issues with your purchased repossessed car, you will have to deal with the repair costs using your own money.

It takes a lot of effort to find and buy the best repo car.

As mentioned earlier, you can buy an almost brand-new repossessed vehicle at a low price. Still, you will have to put a lot of effort and patience into it as the process of buying one can be time-consuming. Moreover, before you get approved to buy a repo vehicle, you have to submit many bids to various banks as your bids may get rejected by these financial institutions, precisely when your offer is below their set floor (minimum) price.

You cannot test drive a repo car.

Most banks will not allow you to test drive a car they want to purchase, while some will let you start the vehicle. Not being able to test drive or start the car can prevent you from checking if there are issues.

But you can address risks of hidden issues by taking your time to assess the vehicle. First, you must look thoroughly at the vehicle’s pictures and get a trusted mechanic to help you inspect the vehicle and evaluate its condition.

Conclusion

Knowing the benefits and drawbacks of purchasing a bank-repossessed vehicle before deciding to proceed with the buying process is imperative. And suppose you do consider buying a repo car. In that case, you should be thorough at inspecting the condition of your chosen vehicle to have the assurance that you are getting a quality vehicle at a lower price.

Furthermore, you should also purchase a comprehensive car insurance Ph to protect your investment. Therefore, you must shop around and compare car insurance policies to determine which policy meets your needs and budget. To make the process of comparing policy coverages and rates from different insurance providers more seamless, you can leverage a comparison website, insurance Philippines.

iChoose PH is the leading car insurance comparison site in the Philippines. It enables car owners to make the right decision when selecting a car insurance policy. Visit our website at www.iChoose.ph to view unbiased quotations from some industry’s leading car insurance companies.

More useful reads from iChoose.ph