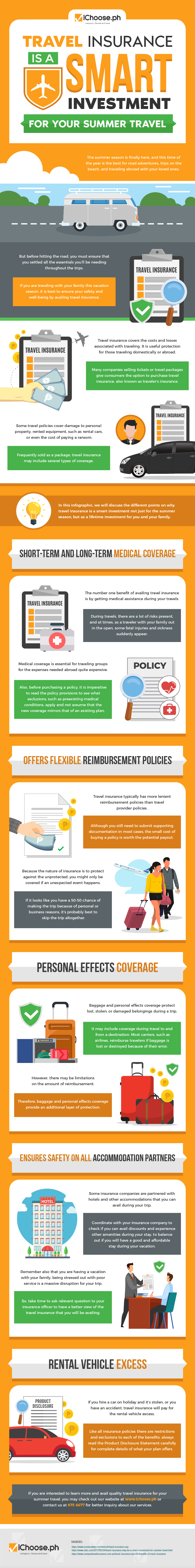

Travel Insurance is a Smart Investment for your Summer Travel [Infographic]

The summer season is finally here, and this time of the year is the best for road adventures, trips on the beach, and traveling abroad with your loved ones. But before hitting the road, you must ensure that you settled all the essentials you’ll be needing throughout the trips. If you are traveling with your family this vacation season, it is best to ensure your safety and wellbeing by availing travel insurance.

Travel insurance covers the costs and losses associated with traveling. It is useful protection for those traveling domestically or abroad. Many companies selling tickets or travel packages give consumers the option to purchase travel insurance, also known as traveler’s insurance.

Some travel policies cover damage to personal property, rented equipment, such as rental cars, or even the cost of paying a ransom. Frequently sold as a package, travel insurance may include several types of coverage. In this infographic, we will discuss the different points on why travel insurance is a smart investment not just for the summer season, but as a lifetime investment for you and your family.

- Short-Term and Long-Term Medical Coverage

– The number one benefit of availing of travel insurance is by getting medical assistance during your travels. During travels, there are a lot of risks present, and at times, as a traveler with your family out in the open, some fatal injuries and sickness suddenly appear.

Medical coverage is essential for traveling groups for the expenses needed abroad quite expensive. Also, before purchasing a policy, it is imperative to read the policy provisions to see what exclusions, such as preexisting medical conditions, apply and not assume that the new coverage mirrors that of an existing plan.

- Offers Flexible Reimbursement Policies

– Travel insurance typically has more lenient reimbursement policies than travel provider policies. Although you still need to submit supporting documentation in most cases, the small cost of buying a policy is worth the potential payout. Because the nature of insurance is to protect against the unprotected, you might only be covered if an unexpected event happens. If it looks like you have a 50-50 chance of making the trip because of personal or business reasons, it’s probably best to skip the trip altogether.

- Personal Effects Coverage

– Baggage and personal effects coverage protect lost, stolen, or damaged belongings during a trip. It may include coverage during travel to and from a destination. Most carriers, such as airlines, reimburse travelers if baggage is lost or destroyed because of their error. However, there may be limitations on the amount of reimbursement. Therefore, baggage and personal effects coverage provide an additional layer of protection.

- Ensures Safety on All Accommodation Partners

– Some insurance companies are partnered with hotels and other accommodations that you can avail of during your trip. Coordinate with your insurance company to check if you can avail discounts and experience other amenities during your stay, to balance out if you will have a good and affordable stay during your vacation.

Remember also that you are having a vacation with your family, being stressed out with poor service is a massive disruption for your trip. So, take the time to ask relevant questions to your insurance officer to have a better view of the travel insurance that you will be availing.

- Rental Vehicle Excess

– If you hire a car on holiday and it’s stolen, or you have an accident, travel insurance will pay for the rental vehicle excess. Like all insurance policies there are restrictions and exclusions to each of the benefits, always read the Product Disclosure Statement carefully for complete details of what your plan offers.

If you are interested to learn more and avail quality travel insurance for your summer travel, you may check out our website at www.ichoose.ph or contact us at 875 6677 for better inquiry about our services.

More useful reads from iChoose.ph