6 Reasons Why Dash Cams are Important for Car Insurance Claims [Infographic]

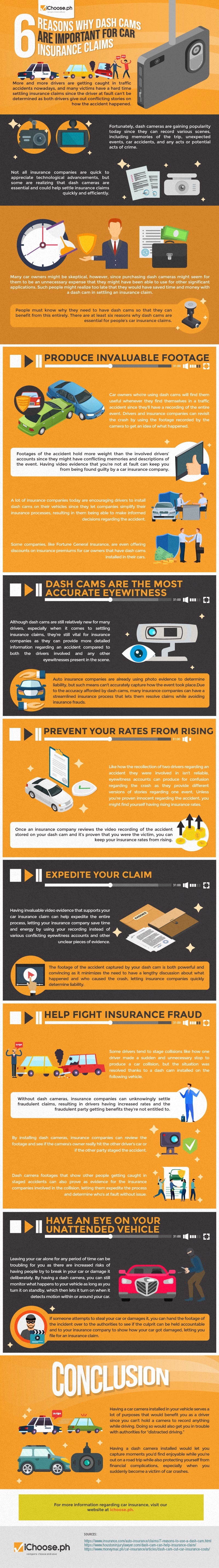

More and more drivers are getting caught in traffic accidents nowadays, and many victims have a hard time settling insurance claims since the driver at fault can’t be determined as both drivers give out conflicting stories on how the accident happened. Fortunately, dash cameras are gaining popularity today since they can record various scenes, including memories of the trip, unexpected events, car accidents, and any acts or potential acts of crime.

Not all insurance companies are quick to appreciate technological advancements, but some are realizing that dash cameras are essential and could help settle insurance claims quickly and efficiently.

Many car owners might be skeptical, however, since purchasing dash cameras might seem for them to be an unnecessary expense that they might have been able to use for other significant applications. Such people might realize too late that they would have saved time and money with a dash cam in settling an insurance claim.

People must know why they need to have dash cams so that they can benefit from this entirely. There are at least six reasons why dash cams are essential for people’s car insurance claims.

Produce Invaluable Footage

Car owners who’re using dash cams will find them useful whenever they find themselves in a traffic accident since they’ll have a recording of the entire event. Drivers and insurance companies can revisit the crash by using the footage recorded by the camera to get an idea of what happened.

Footages of the accident hold more weight than the involved drivers’ accounts since they might have conflicting memories and descriptions of the event. Having video evidence that you’re not at fault can keep you from being found guilty by a car insurance company.

A lot of insurance companies today are encouraging drivers to install dash cams on their vehicles since they let companies simplify their insurance processes, resulting in them being able to make informed decisions regarding the accident.

Some companies, like Fortune General Insurance, are even offering discounts on insurance premiums for car owners that have dash cams installed in their cars.

Dash Cams are the Most Accurate Eyewitness

Although dash cams are still relatively new for many drivers, especially when it comes to settling insurance claims, they’re still vital for insurance companies as they can provide more detailed information regarding an accident compared to both the drivers involved and any other eyewitnesses present in the scene. Auto insurance companies are already using photo evidence to determine liability, but such means can’t accurately capture how the event took place.

Due to the accuracy afforded by dash cams, many insurance companies can have a streamlined insurance process that lets them resolve claims while avoiding insurance frauds.

Prevent Your Rates from Rising

Like how the recollection of two drivers regarding an accident they were involved in isn’t reliable, eyewitness accounts can produce for confusion regarding the crash as they provide different versions of stories regarding one event. Unless you’re proven innocent regarding the accident, you might find yourself having rising insurance rates.

Once an insurance company reviews the video recording of the accident stored on your dash cam and it’s proven that you were the victim, you can keep your insurance rates from rising.

Expedite Your Claim

Having invaluable video evidence that supports your car insurance claim can help expedite the entire process, letting your insurance company save time and energy by using your recording instead of various conflicting eyewitness accounts and other unclear pieces of evidence.

The footage of the accident captured by your dash cam is both powerful and convincing as it minimizes the need to have a lengthy discussion about what happened and who caused the crash, letting insurance companies quickly determine liability.

Help Fight Insurance Fraud

Some drivers tend to stage collisions like how one driver made a sudden and unnecessary stop to produce a car collision, but the situation was resolved thanks to a dash cam installed on the following vehicle.

Without dash cameras, insurance companies can unknowingly settle fraudulent claims, resulting in drivers having increased rates and the fraudulent party getting benefits they’re not entitled to. By installing dash cameras, insurance companies can review the footage and see if the camera’s owner really hit the other driver’s car or if the other party staged the accident.

Dash camera footages that show other people getting caught in staged accidents can also prove as evidence for the insurance companies involved in the collision, letting them expedite the process and determine who’s at fault without issue.

Have an Eye on Your Unattended Vehicle

Leaving your car alone for any period of time can be troubling for you as there are increased risks of having people try to break in your car or damage it deliberately. By having a dash camera, you can still monitor what happens to your vehicle as long as you turn it on standby, which then lets it turn on when it detects motion within or around your car.

If someone attempts to steal your car or damages it, you can hand the footage of the incident over to the authorities to see if the culprit can be held accountable and to your insurance company to show how your car got damaged, letting you file for an insurance claim.

Conclusion

Having a car camera installed in your vehicle serves a lot of purposes that would benefit you as a driver since you can’t hold a camera to record anything while driving. Doing so would also get you in trouble with authorities for “distracted driving.”

Having a dash camera installed would let you capture moments you’d find enjoyable while you’re out on a road trip while also protecting yourself from financial complications, especially when you suddenly become a victim of car crashes.

For more information regarding car insurance, visit our website at ichoose.ph.

More useful reads from iChoose.ph