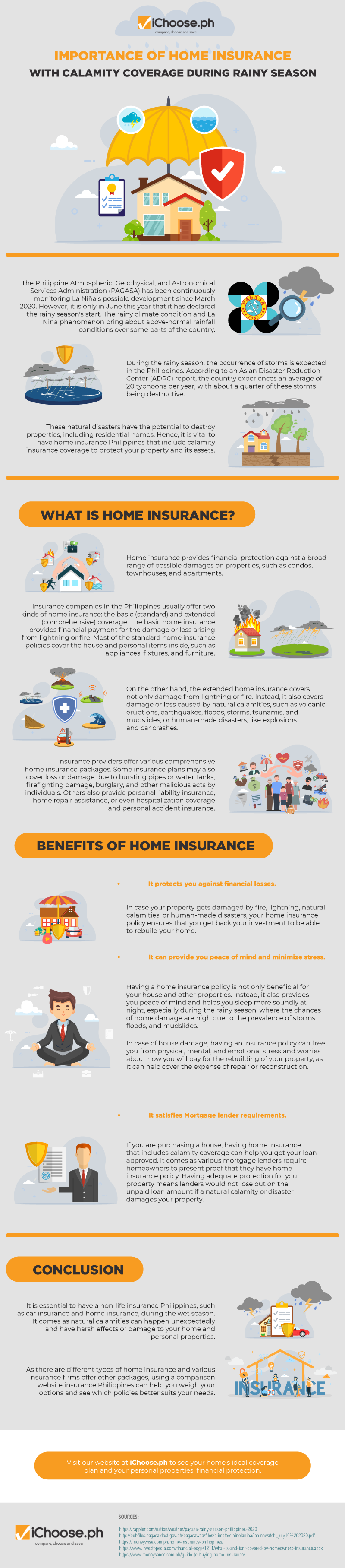

Importance of Home Insurance with Calamity Coverage During Rainy Season [Infographic]

The Philippine Atmospheric, Geophysical, and Astronomical Services Administration (PAGASA) has been continuously monitoring La Niña’s possible development since March 2020. However, it is only in June this year that it has declared the rainy season’s start. The rainy climate condition and La Nina phenomenon bring about above-normal rainfall conditions over some parts of the country.

During the rainy season, the occurrence of storms is expected in the Philippines. According to an Asian Disaster Reduction Center (ADRC) report, the country experiences an average of 20 typhoons per year, with about a quarter of these storms being destructive.

These natural disasters have the potential to destroy properties, including residential homes. Hence, it is vital to have home insurance Philippines that include calamity insurance coverage to protect your property and its assets.

What is home insurance?

Home insurance provides financial protection against a broad range of possible damages on properties, such as condos, townhouses, and apartments.

Insurance companies in the Philippines usually offer two kinds of home insurance: the basic (standard) and extended (comprehensive) coverage. The basic home insurance provides financial payment for the damage or loss arising from lightning or fire. Most of the standard home insurance policies cover the house and personal items inside, such as appliances, fixtures, and furniture.

On the other hand, the extended home insurance covers not only damage from lightning or fire. Instead, it also covers damage or loss caused by natural calamities, such as volcanic eruptions, earthquakes, floods, storms, tsunamis, and mudslides, or human-made disasters, like explosions and car crashes.

Insurance providers offer various comprehensive home insurance packages. Some insurance plans may also cover loss or damage due to bursting pipes or water tanks, firefighting damage, burglary, and other malicious acts by individuals. Others also provide personal liability insurance, home repair assistance, or even hospitalization coverage and personal accident insurance.

Benefits of home insurance

- It protects you against financial losses

In case your property gets damaged by fire, lightning, natural calamities, or human-made disasters, your home insurance policy ensures that you get back your investment to be able to rebuild your home.

- It can provide you peace of mind and minimize stress.

Having a home insurance policy is not only beneficial for your house and other properties. Instead, it also provides you peace of mind and helps you sleep more soundly at night, especially during the rainy season, where the chances of home damage are high due to the prevalence of storms, floods, and mudslides.

In case of house damage, having an insurance policy can free you from physical, mental, and emotional stress and worries about how you will pay for the rebuilding of your property, as it can help cover the expense of repair or reconstruction.

- It satisfies Mortgage lender requirements.

If you are purchasing a house, having home insurance that includes calamity coverage can help you get your loan approved. It comes as various mortgage lenders require homeowners to present proof that they have home insurance policy. Having adequate protection for your property means lenders would not lose out on the unpaid loan amount if a natural calamity or disaster damages your property.

Conclusion

It is essential to have a non-life insurance Philippines, such as car insurance and home insurance, during the wet season. It comes as natural calamities can happen unexpectedly and have harsh effects or damage to your home and personal properties.

As there are different types of home insurance and various insurance firms offer other packages, using a comparison website insurance Philippines can help you weigh your options and see which policies better suits your needs.

Visit our website at iChoose.ph to see your home’s ideal coverage plan and your personal properties’ financial protection.

More useful reads from iChoose.ph