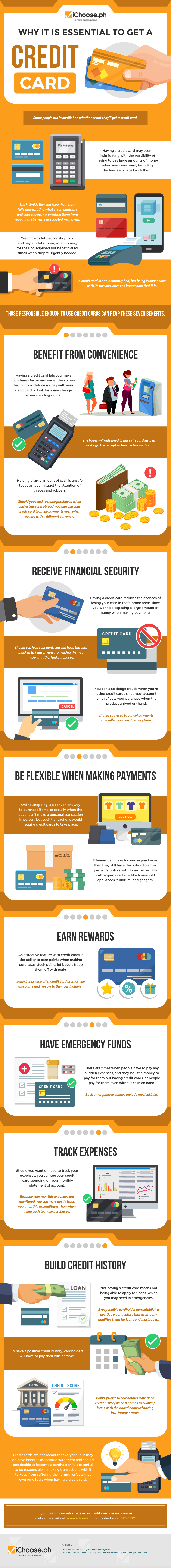

Why it is Essential to Get a Credit Card [Infographic]

Some people are in conflict on whether or not they’ll get a credit card. Having a credit card may seem intimidating with the possibility of having to pay large amounts of money when you overspend, including the fees associated with them. The intimidation can keep them from fully appreciating what credit cards are and subsequently preventing them from reaping the benefits associated with them.

Credit cards let people shop now and pay at a later time, which is risky for the undisciplined but beneficial for times when they’re urgently needed. A credit card is not inherently bad, but being irresponsible with its use can leave the impression that it is.

Those responsible enough to use credit cards can reap these seven benefits:

Benefit From Convenience

Having a credit card lets you make purchases faster and easier than when having to withdraw money with your debit card or look for some change when standing in line. The buyer will only need to have the card swiped and sign the receipt to finish a transaction.

Holding a large amount of cash is unsafe today as it can attract the attention of thieves and robbers. Should you need to make purchases while you’re traveling abroad, you can use your credit card to make payments even when paying with a different currency.

Receive Financial Security

Having a credit card reduces the chances of losing your cash in theft-prone areas since you won’t be exposing a large amount of money when making payments. Should you lose your card, you can have the card blocked to keep anyone from using them to make unauthorized purchases.

You can also dodge frauds when you’re using credit cards since your account only reflects your purchase when the product arrived on-hand. Should you need to cancel payments to a seller, you can do so anytime.

Be Flexible When Making Payments

Online shopping is a convenient way to purchase items, especially when the buyer can’t make a personal transaction in person, but such transactions would require credit cards to take place.

If buyers can make in-person purchases, then they still have the option to either pay with cash or with a card, especially with expensive items like household appliances, furniture, and gadgets.

Earn Rewards

An attractive feature with credit cards is the ability to earn points when making purchases. Such points let buyers trade them off with perks. Some banks also offer credit card promos like discounts and freebie to their cardholders.

Have Emergency Funds

There are times when people have to pay any sudden expenses, and they lack the money to pay for them but having credit cards let people pay for them even without cash on hand. Such emergency expenses include medical bills.

Track Expenses

Should you want or need to track your expenses, you can see your credit card spending on your monthly statement of account.

Because your monthly expenses are monitored, you can more easily track your monthly expenditures than when using cash to make purchases.

Build Credit History

Not having a credit card means not being able to apply for loans, which you may need in emergencies. A responsible cardholder can establish a positive credit history that eventually qualifies them for loans and mortgages.

To have a positive credit history, cardholders will have to pay their bills on time. Banks prioritize cardholders with good credit history when it comes to allowing loans with the added bonus of having low-interest rates.

Credit cards are not meant for everyone, but they do have benefits associated with them and should one decide to become a cardholder, it is essential to be responsible in making transactions with it to keep from suffering the harmful effects that everyone fears when having a credit card.

If you need more information on credit cards or insurances, visit our website at www.ichoose.ph or contact us at 875 6677.

Sources:

https://www.moneymax.ph/guide/credit-cards-beginners/

https://www.fwd.com.ph/en/live/all_topics/all_articles/5-reasons-why-you-should-get-a-credit-card/

More useful reads from iChoose.ph