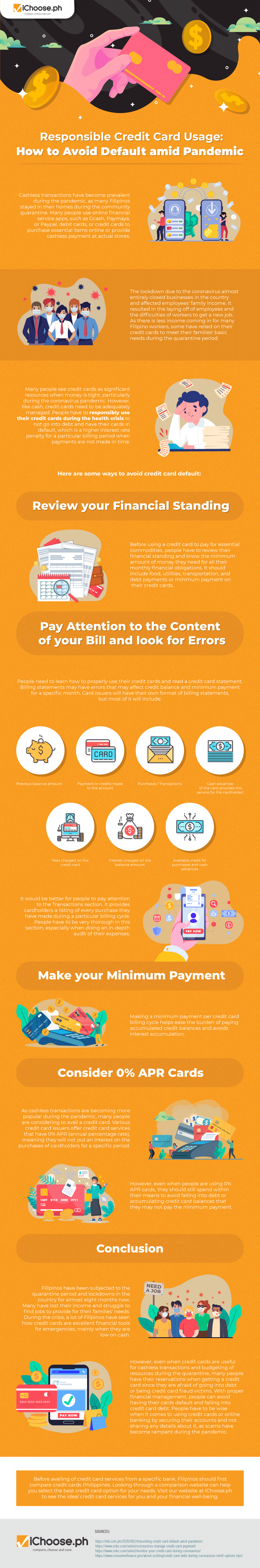

Responsible Credit Card Usage: How to Avoid Default amid Pandemic [Infographic]

Cashless transactions have become prevalent during the pandemic, as many Filipinos stayed in their homes during the community quarantine. Many people use online financial service apps, such as Gcash, Paymaya, or Paypal, debit cards, or credit cards to purchase essential items online or provide cashless payment at actual stores.

The lockdown due to the coronavirus almost entirely closed businesses in the country and affected employees’ family income. It resulted in the laying off of employees and the difficulties of workers to get a new job. As there is less income coming in for many Filipino workers, some have relied on their credit cards to meet their families’ basic needs during the quarantine period.

Many people see credit cards as significant resources when money is tight, particularly during the coronavirus pandemic. However, like cash, credit cards need to be adequately managed. People have to responsibly use their credit cards during the health crisis to not go into debt and have their cards in default, which is a higher interest rate penalty for a particular billing period when payments are not made in time.

Here are some ways to avoid credit card default:

- Review your financial standing

Before using a credit card to pay for essential commodities, people have to review their financial standing and know the minimum amount of money they need for all their monthly financial obligations. It should include food, utilities, transportation, and debt payments or minimum payment on their credit cards.

- Pay attention to the content of your bill and look for errors

People need to learn how to properly use their credit cards and read a credit card statement. Billing statements may have errors that may affect credit balance and minimum payment for a specific month. Card issuers will have their own format of billing statements, but most of it will include:

- Previous balance amount

- Payment or credits made to the account

- Purchases/Transactions

- Cash advances (if the card provides this service for the cardholder)

- Fees charged on the credit card

- Interest charged on the balance amount

- Available credit for purchases and cash advances

It would be better for people to pay attention to the Transactions section. It provides cardholders a listing of every purchase they have made during a particular billing cycle. People have to be very thorough in this section, especially when doing an in-depth audit of their expenses.

- Make your minimum payment

Making a minimum payment per credit card billing cycle helps ease the burden of paying accumulated credit balances and avoids interest accumulation.

- Consider 0% APR cards

As cashless transactions are becoming more popular during the pandemic, many people are considering to avail a credit card. Various credit card issuers offer credit card services that have 0% APR (annual percentage rate), meaning they will not put an interest on the purchases of cardholders for a specific period.

However, even when people are using 0% APR cards, they should still spend within their means to avoid falling into debt or accumulating credit card balances that they may not pay the minimum payment.

Conclusion

Filipinos have been subjected to the quarantine period and lockdowns in the country for almost eight months now. Many have lost their income and struggle to find jobs to provide for their families’ needs. During the crisis, a lot of Filipinos have seen how credit cards are excellent financial tools for emergencies, mainly when they are low on cash.

However, even when credit cards are useful for cashless transactions and budgeting of resources during the quarantine, many people have their reservations when getting a credit card since they are afraid of going into debt or being credit card fraud victims. With proper financial management, people can avoid having their cards default and falling into credit card debt. People have to be wise when it comes to using credit cards or online banking by securing their accounts and not sharing any details about it, as scams have become rampant during the pandemic.

Before availing of credit card services from a specific bank, Filipinos should first compare credit cards Philippines. Looking through a comparison website can help you select the best credit card option for your needs. Visit our website at iChoose.ph to see the ideal credit card services for you and your financial well-being.

More useful reads from iChoose.ph