Types of Car Coverage Insurance [Infographic]

The world of car insurance is an intimidating and overwhelming one. While it is understandable that you may feel confused with all the terminologies and specifications, it should not be an excuse for you not to try and understand it—moreover, get one for yourself.

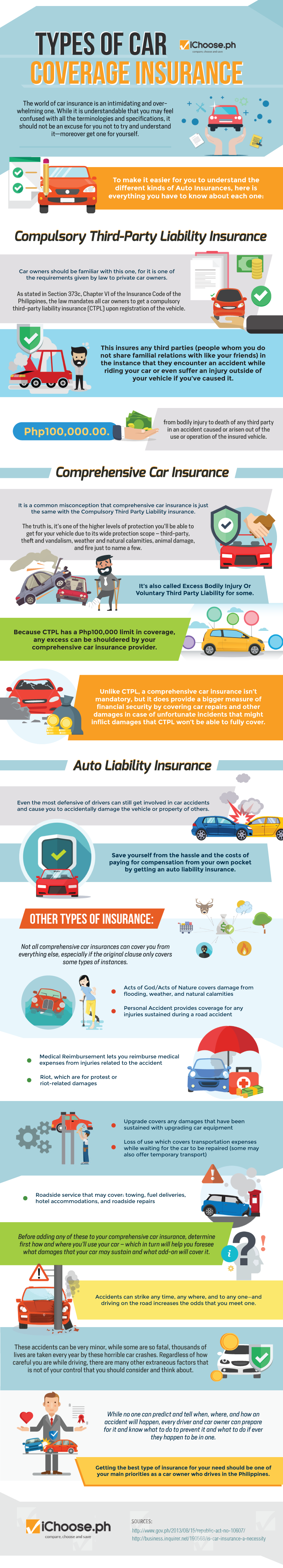

To make it easier for you to understand the different kinds of Auto Insurances, here is everything you have to know about each one:

Compulsory Third-Party Liability Insurance

Car owners should be familiar with this one, for it is one of the requirements given by law to private car owners. As stated in Section 373c, Chapter VI of the Insurance Code of the Philippines, the law mandates all car owners to get compulsory third-party liability insurance (CTPL) upon registration of the vehicle.

This ensures any third parties (people whom you do not share familial relations with like your friends) in the instance that they encounter an accident while riding your car or even suffer an injury outside of your vehicle if you’ve caused it.

This coverage accounts for up to Php100,000, from bodily injury to death of any third party in an accident caused or arisen out of the use or operation of the insured vehicle.

Comprehensive Car Insurance

It is a common misconception that comprehensive car insurance is just the same as the Compulsory Third Party Liability insurance. The truth is, it’s one of the higher levels of protection you’ll be able to get for your vehicle due to its wide protection scope – third-party, theft and vandalism, weather and natural calamities, animal damage, and fire just to name a few.

It’s also called Excess Bodily Injury Or Voluntary Third Party Liability for some.

Because CTPL has a Php100,000 limit in coverage, any excess can be shouldered by your comprehensive car insurance provider. Unlike CTPL, comprehensive car insurance isn’t mandatory, but it does provide a bigger measure of financial security by covering car repairs and other damages in case of unfortunate incidents that might inflict damages that CTPL won’t be able to fully cover.

Auto Liability Insurance

Even the most defensive of drivers can still get involved in car accidents and cause you to accidentally damage the vehicle or property of others. Save yourself from the hassle and the costs of paying for compensation from your own pocket by getting an auto liability insurance.

Other types of insurance:

Not all comprehensive car insurance can cover you from everything else, especially if the original clause only covers some types of instances.

- Acts of God/Acts of Nature covers damage from flooding, weather, and natural calamities

- Personal Accident provides coverage for any injuries sustained during a road accident

- Medical Reimbursement lets you reimburse medical expenses from injuries related to the accident

- Riot, which is for protest or riot-related damages

- The upgrade covers any damages that have been sustained with upgrading car equipment

- Loss of use which covers transportation expenses while waiting for the car to be repaired (some may also offer temporary transport)

- Roadside service that may cover: towing, fuel deliveries, hotel accommodations, and roadside repairs

Before adding any of these to your comprehensive car insurance, determine first how and where you’ll use your car – which in turn will help you foresee what damages that your car may sustain and what add-on will cover it.

Accidents can strike any time, anywhere, and to anyone—and driving on the road increases the odds that you meet one. These accidents can be very minor, while some are so fatal, thousands of lives are taken every year by these horrible car crashes. Regardless of how careful you are while driving, there are many other extraneous factors that are not of your control that you should consider and think about.

While no one can predict and tell when, where, and how an accident will happen, every driver and the car owner can prepare for it and know what to do to prevent it and what to do if ever they happen to be in one.

Getting the best type of insurance for your need should be one of your main priorities as a car owner who drives in the Philippines.

More useful reads from iChoose.ph

![Surety Bond Insurance: What Is It and Why Is It Important? [Infographic]](https://ichoose.ph/blogs/wp-content/plugins/wordpress-23-related-posts-plugin/static/thumbs/23.jpg)