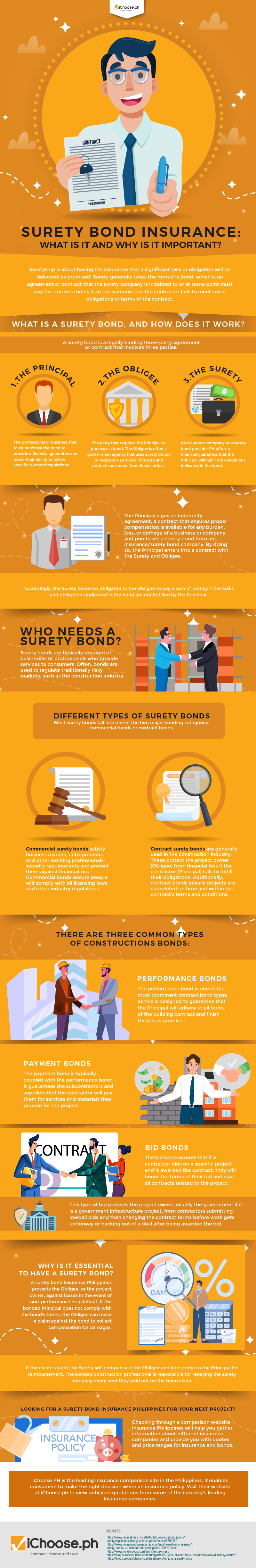

Surety Bond Insurance: What Is It and Why Is It Important? [Infographic]

Suretyship is about having the assurance that a significant task or obligation will be delivered as promised. Surety generally takes the form of a bond, which is an agreement or contract that the surety company is indebted to or at some point must pay the one who holds it, in the scenario that the contractor fails to meet some obligations or terms of the contract.

What is a surety bond, and how does it work?

A surety bond is a legally binding three-party agreement or contract that involves three parties:

- The Principal – The professional or business that must purchase the bond to provide a financial guarantee and prove their ability to follow specific laws and regulations.

- The Obligee – The party that requires the Principal to purchase a bond. The Obligee is often a government agency that uses surety bonds to regulate a particular industry and protect consumers from financial loss.

- The Surety – An insurance company or a surety bond provider PH offers a financial guarantee that the Principal will fulfill the obligations indicated in the bond.

The Principal signs an indemnity agreement, a contract that ensures proper compensation is available for any burden, loss, or damage of a business or company, and purchases a surety bond from an insurance/surety bond company. By doing so, the Principal enters into a contract with the Surety and Obligee.

Accordingly, the Surety becomes obligated to the Obligee to pay a sum of money if the tasks and obligations indicated in the bond are not fulfilled by the Principal.

Who needs a surety bond?

Surety bonds are typically required of businesses or professionals who provide services to consumers. Often, bonds are used to regulate traditionally risky markets, such as the construction industry.

Different types of surety bonds

Most surety bonds fall into one of the two major bonding categories: commercial bonds or contract bonds.

Commercial surety bonds satisfy business owners, entrepreneurs, and other working professionals’ security requirements and protect them against financial risk. Commercial bonds ensure people will comply with all licensing laws and other industry regulations.

Contract surety bonds are generally used in the construction industry. These protect the project owner (Obligee) from financial loss if the contractor (Principal) fails to fulfill their obligations. Additionally, contract bonds ensure projects are completed on time and within the contract’s terms and conditions.

There are three common types of constructions bonds:

Performance Bonds

The performance bond is one of the most prominent contract bond types as this is designed to guarantee that the Principal will adhere to all terms of the building contract and finish the job as promised.

Payment bonds

The payment bond is typically coupled with the performance bond. It guarantees the subcontractors and suppliers that the contractor will pay them for services and materials they provide for the project.

Bid bonds

The bid bond assures that if a contractor bids on a specific project and is awarded the contract, they will honor the terms of their bid and sign all contracts related to the project.

This type of bid protects the project owner, usually the government if it is a government infrastructure project, from contractors submitting lowball bids and then changing the contract terms before work gets underway or backing out of a deal after being awarded the bid.

Why is it essential to have a surety bond?

A surety bond insurance Philippines protects the Obligee, or the project owner, against losses in the event of non-performance or a default. If the bonded Principal does not comply with the bond’s terms, the Obligee can make a claim against the bond to collect compensation for damages.

If the claim is valid, the Surety will compensate the Obligee and later come to the Principal for reimbursement. The bonded construction professional is responsible for repaying the surety company every cent they paid out on the bond claim.

Looking for a surety bond insurance Philippines for your next project?

Checking through a comparison website insurance Philippines will help you gather information about different insurance companies and provide you with quotes and price ranges for insurance and bonds.

iChoose PH is the leading insurance comparison site in the Philippines. It enables consumers to make the right decision when an insurance policy. Visit their website at iChoose.ph to view unbiased quotations from some of the industry’s leading insurance companies.

Sources:

- https://www.manilatimes.net/2020/01/20/opinion/columnists/suretyship-bonds-that-guarantee-performance/675926/

- https://www.insurancebusinessmag.com/asia/news/breaking-news/surety-bonds–a-brief-introductory-guide-169527.aspx

- https://www.investopedia.com/terms/s/surety.asp

- https://blog.suretysolutions.com/suretynews/6-types-of-contract-surety-bonds-and-what-they-insure?

- https://blog.suretysolutions.com/suretynews/what-is-a-surety-bond

More useful reads from iChoose.ph