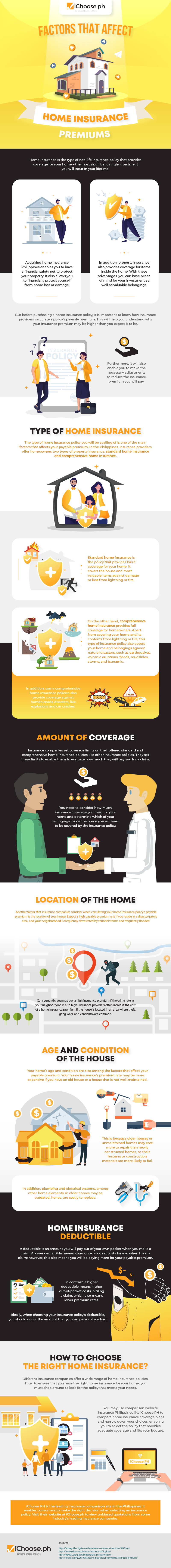

Factors that Affect Home Insurance Premiums

Home insurance is the type of non-life insurance policy that provides coverage for your home – the most significant single investment you will incur in your lifetime.

Acquiring home insurance Philippines enables you to have a financial safety net to protect your property. It also allows you to protect yourself from home loss or damage financially. In addition, property insurance also provides coverage for items inside the home. With these advantages, you can have peace of mind for your investment as well as valuable belongings.

But before purchasing a home insurance policy, it is essential to know how insurance providers calculate a policy’s payable premium. This will help you understand why your insurance premium may be higher than you expect it to be. Furthermore, it will also enable you to make the necessary adjustments to reduce the insurance premium you will pay.

Type of Home Insurance

The type of home insurance policy you will be availing of is one of the main factors that affects your payable premium. In the Philippines, insurance providers offer homeowners two types of property insurance: standard home insurance and comprehensive home insurance.

Standard home insurance is the policy that provides basic coverage for your home. It covers the house and most valuable items against damage or loss from lightning or fire.

On the other hand, comprehensive home insurance provides complete coverage for homeowners. Apart from covering your home and its contents from lightning or fire, this type of insurance policy also protects your home and belongings against natural disasters, such as earthquakes, volcanic eruptions, floods, mudslides, storms, and tsunamis. In addition, some comprehensive home insurance policies also provide coverage against human-made disasters, like explosions and car crashes.

Amount of Coverage

Insurance companies set coverage limits on their offered standard and comprehensive home insurance policies like other insurance policies. They put these limits to enable them to evaluate how much they will pay you for a claim.

You need to consider how much insurance coverage you need for your home and determine which of your belongings inside the home you will want to be covered by the insurance policy.

Location of the Home

Another factor that insurance companies consider when calculating your home insurance policy’s payable premium is the location of your house. Expect a high payable premium rate if you reside in a disaster-prone area, and your neighborhood is frequently devastated by thunderstorms and often flooded.

Consequently, you may pay a high insurance premium if the crime rate in your neighborhood is also high. Insurance providers often increase the cost of a home insurance premium if the house is located in an area where theft, gang wars, and vandalism are common.

Age and Condition of the House

Your home’s age and condition are also among the factors that affect your payable premium. Your home insurance’s premium rate may be more expensive if you have an old house or a house that is not well-maintained. This is because older houses or unmaintained homes may cost more to repair than newly constructed homes, as their features or construction materials are more likely to fail. In addition, in older houses, plumbing and electrical systems, among other home elements, may be outdated, hence, costly to replace.

Home Insurance Deductible

A deductible is an amount you will pay out of your pocket when you make a claim. A lower deductible means lower out-of-pocket costs for you when filing a claim; however, this also means you will be paying more for your payable premium. In contrast, a higher deductible means higher out-of-pocket costs in filing a claim, which means lower premium rates.

Ideally, when choosing your insurance policy’s deductible, you should go for the amount that you can personally afford.

How to Choose the Right Home Insurance?

Different insurance companies offer a wide range of home insurance policies. Thus, to ensure that you have the right home insurance for your home, you must shop around to look for the policy that meets your needs. You may use comparison website insurance Philippines like iChoose PH to compare home insurance coverage plans and narrow down your choices, enabling you to select the policy that provides adequate coverage and fits your budget.

iChoose PH is the leading insurance comparison site in the Philippines. It enables consumers to make the right decision when selecting an insurance policy. Visit their website at iChoose.ph to view unbiased quotations from some industry’s leading insurance companies.

Read More: What is Covered by Standard Home Insurance in the Philippines?

More useful reads from iChoose.ph